The year 2022 may be remembered for the invasion of Ukraine, the Olympics, or the passing of Queen Elizabeth II. Unfortunately for financial markets it would rather be forgotten. This was on the back of COVID-19 disruptions which ultimately saw a new chapter in the history books.

Equity markets declined significantly as economic uncertainty set in quickly. The S&P500 is down -15% to date after a true bear market low of -23% in October (blue line). The ASX faired much better, down a modest -4% to date, although you would be forgiven to think otherwise after a grim -15% fall in October (orange line):

Yet, it was high inflation and accelerated interest rate hikes that lead to a dramatic increase in bond yields, across the US (red line) and Australia (green line):

Simply put, as bond yields rise the price of the bond falls. We witnessed sharp yield increases from March and the selloff kicked in with wide credit spreads and liquidity issues. Bonds fell up to 15% to the extent the Bank of England described it as “dysfunction” in the market, purchasing long-dated bonds in September to save pension schemes and create an element of stability. The Bank of America announced it as the “worst sell of since 1949”.

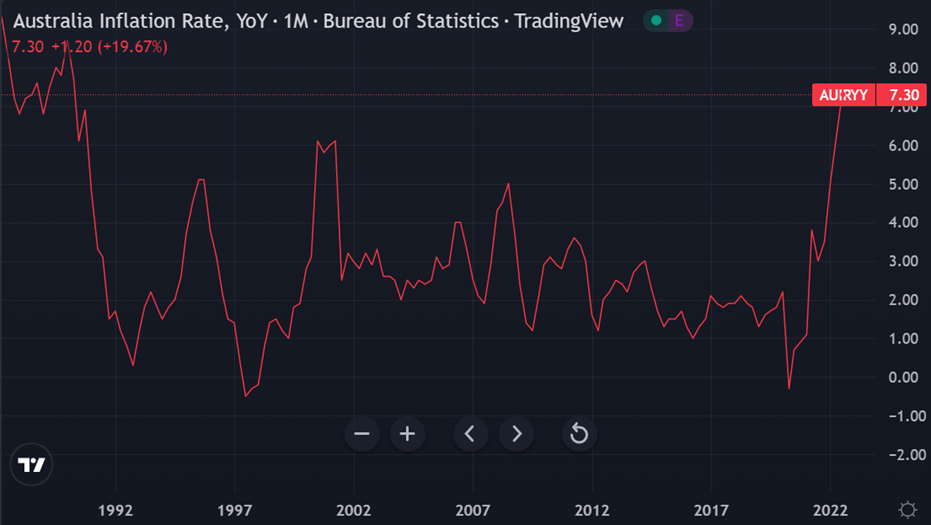

Apart from deflationary China which oddly saw the second largest economy going against its peers, Australia began to suffer inflation levels last seen in 1990 as did many other countries. This was partly due to demand for consumer goods post pandemic restrictions with continued lack of supply. Take petrol prices for example, up 37% for the year by June.

The last time bond equities fell so greatly was in 1931 and 1969. This led to abnormal volatility across all risk profiles for investors. We began to see a highly unusual trend emerge where aggressive and moderate risk profiles suffered in unison. As shown below, the return to date has been similar across varying degrees of risk, still down close to -7%. This proves markets are not in normal times.

So how does this impact the average balanced investor, especially in times of high inflation? The short answer is not much.

We accept volatility in equities. We generally accept bonds to have an inverse relation with equities, smoothing out portfolio returns. Bonds are an important part of a portfolio. Short term correlation to equities shouldn’t detract from the importance of real diversification, which has never been so crucial.

2022 was an extreme event. As Howard Marks says, “volatility is just a temporary phenomenon.” The expectation is that the phenomenon doesn’t happen 90% of the time and diversification wins in end.

If you have any questions regarding the above, contact Associate Director and Financial Adviser, Ben Travers at btravers@prosperity.com.au. Alternatively, you may contact your Principal Adviser on 1300 795 515 to discuss.

This communication contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Prosperity Wealth Advisers (ABN 32 141 396 376) is an authorised representative of Prosperity Wealth Advisory Services Pty Ltd, Australian Financial Services Licensee (533675).