The recently announced land tax changes in Queensland has shaken the investment scene in the sunny state. This is the second increase in tax after the Queensland Labor State Government retained power in 2020 on the premise of “no new taxes” (first increase was the coal excise increase in June 2022).

Whilst there is no new tax or increase in rate, the impacts of the new calculation is to effectively work out total land tax on a theoretical land holding Australia wide (based on Queensland rates) then apportion the “QLD” component of this calculation. This change in Queensland land tax is based on Queensland and Australian wide land holdings as at 30 June 2023 at midnight.

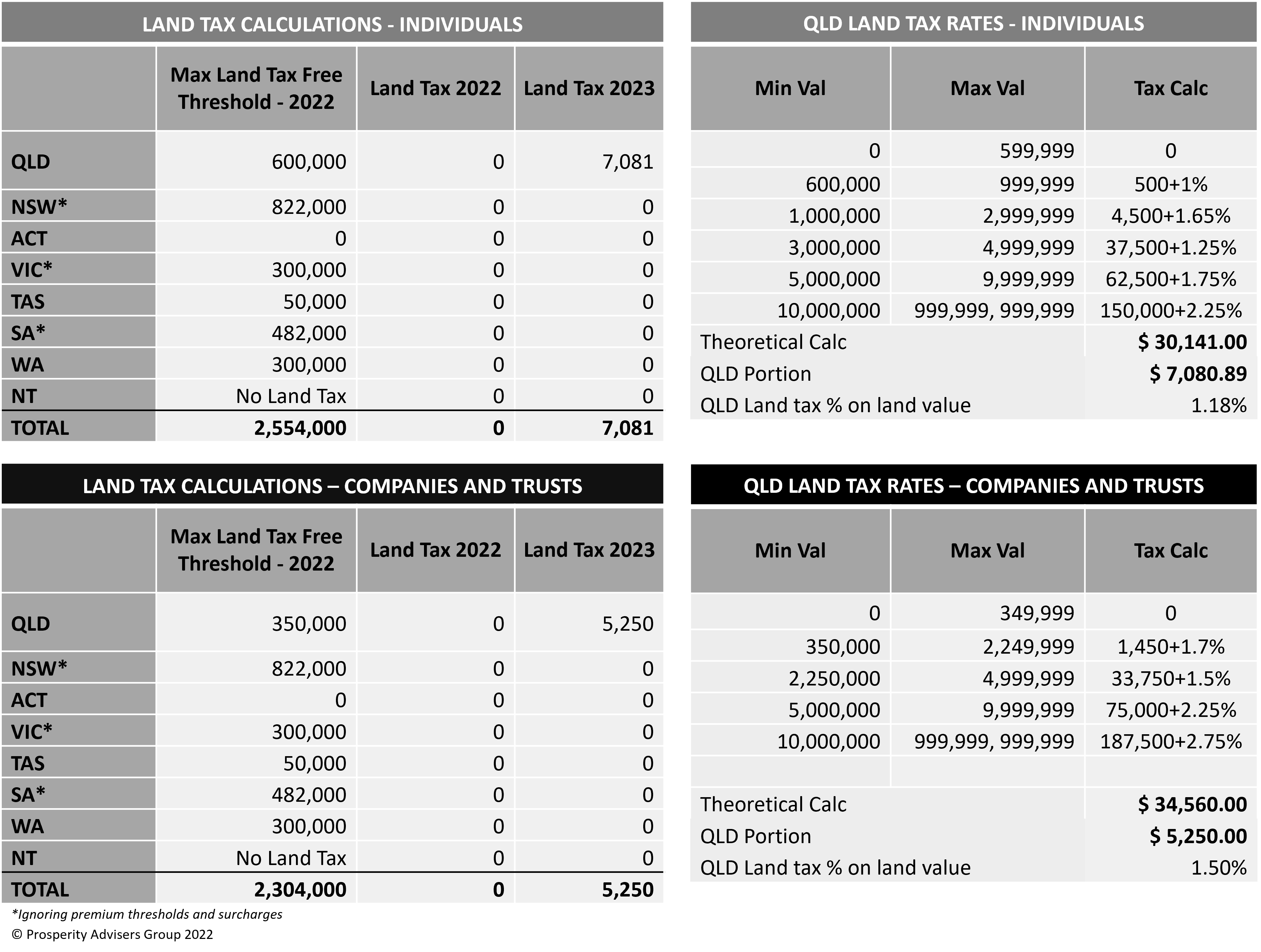

The table below shows the impact of the Queensland land tax changes (on land holdings at 12 midnight on 30 June) assuming that the investor owns property with land value to the maximum tax free threshold in all states and territories in Australia:

The press have been reporting that this is already having a major impact on investor sentiment in Queensland (from REIQ) with other states and territories having no such national approach to calculation of a state based land tax. There is a similar process with the harmonised payroll tax between the states and territories in Australia but this operates to lower the thresholds in Queensland (and in other states) to calculate payroll tax in each state.

On the weekend, the Queensland State Treasurer, Cameron Dick, guaranteed that there would be no increase to residential rent paid due to the increase in Land Tax. However, with all investments and especially real estate, yield is king. Therefore, assuming the above increases in land tax, rents would have to rise 11.3% for individual landlords to 14.4% for company/trust landlords to keep yield constant with the new Queensland land tax impost. It will be interesting how this state government guarantee will be enforced on the private investors.

A Queensland housing summit is to meet in a months’ time after a round table was convened by the Queensland State Government on 16 September 2022 to address the increasing housing crisis in the state. Premier Annastacia Palaszczuk will consider land supplies and social housing. The housing summit should also review the current increase in construction costs, restriction in subcontractors and the overall impact of major infrastructure spending (cross river rail, Queens Wharf, Olympics) which will further put pressure on costs of investment into residential investments. Timing of this new tax will have impacts on the sector moving forward.

If you have any questions regarding the above, please contact Director of Business Services and Taxation Steve Gagel on 0414777660 or email at sgagel@prosperity.com.au.